Pakistan’s Digital Loan Scheme for Farmers

The federal government has launched a new initiative to give smallholder farmers quick, collateral-free credit via partner banks. This program aims to fund essential inputs such as seeds, fertiliser, and diesel before critical sowing windows. The offer is unsecured and built to lower barriers for small producers.

The entire application and disbursement flow runs online through the PM’s Youth Programme portal. Applicants use the PMYP portal and mobile app to apply, track status, and access SMEDA advisory support. Banks involved include Bank of Punjab (BOP), UBL, MCB, and Bank Alfalah.

This initiative connects to the prime minister’s broader push for financial inclusion and agriculture modernization. Features such as e-KYC and digital warehouse receipts aim to speed processing and protect transactions. Note the June 2025 announcement and check with your chosen bank for active windows and eligibility limits.

Key Takeaways

- The government-backed initiative offers fast, collateral-free working capital to buy key inputs.

- Applications and payouts are fully online through the PMYP portal and mobile app.

- Partner banks BOP, UBL, MCB and Bank Alfalah will disburse funds digitally.

- Non-resident Pakistanis and government employees are excluded per PMYP policy.

- SMEDA provides free advisory support; e-KYC and warehouse receipts speed processing.

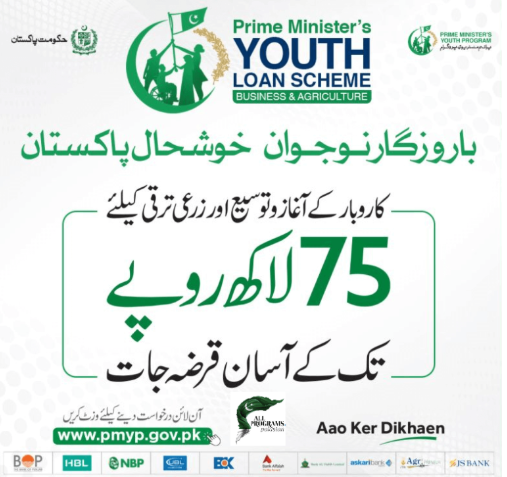

Overview: Government’s new digital agriculture financing and how it complements PMYB&ALS

The government rolled out a fast online facility to fund seasonal input needs like seed, fertiliser, and diesel. This initiative gives smallholders quick working capital with a predictable amount cap and simplified onboarding.

What the product covers

The unsecured product covers essential inputs up to Rs 1 million. Disbursement is entirely digital and routed through partner banks to the farmer’s account, so purchases align with sowing windows.

Who is behind it

The policy was announced in the June 2025 federal budget by Finance Minister Muhammad Aurangzeb and is operationalised via the prime minister youth platform. Participating banks—Bank of Punjab (BOP), UBL, MCB and Bank Alfalah—underwrite and disburse funds.

How it complements PMYB&ALS

PMYB&ALS offers tiered subsidised financing for broader business agriculture needs, from 0% at T1 (up to Rs 0.5 million) to modest mark-ups for larger facilities. The new online product focuses on in-season purchases and can be used alongside longer-tenor PMYB&ALS facilities.

- Fast access: quick working capital for inputs.

- Governance: finance ministry sets policy; PM’s Youth Programme runs applications.

- Bank roles: underwriting, digital KYC, and account disbursement.

- Practical note: applicants should estimate seasonal needs and confirm age and eligibility under KYC rules before applying.

Digital Loan Scheme for Farmers

Know the eligibility rules and the documents you need so your application moves through the portal quickly.

Who qualifies

Target applicant: a genuine smallholder who owns or leases land and actively cultivates crops. The program accepts resident Pakistanis who can show farming activity and a clean credit record.

Age and residency

The general age limit is 18-60 years for the online facility. Youth participants under PMYB&ALS should check bank-specific age rules before applying.

Required documents

Core documents include a valid CNIC, proof of farming activity (fard/jama bandi or lease papers), and an Electronic Warehouse Receipt when borrowing against stored commodities.

Who cannot apply

Non-resident Pakistanis and government employees are excluded under PMYP policy. Applicants must not be defaulters at any financial institution.

| Requirement | Details | Notes |

|---|---|---|

| Applicant type | Smallholder owner or tenant | Must actively cultivate crops |

| Age | 18–60 years | Youth rules vary under PMYB&ALS |

| Key documents | CNIC, land proof, EWR (if applicable) | Bank may request extra proof |

| Submission channel | Online portal only | https://pmyp.gov.pk/bankform/newapplicantform |

Tip: Request only the amount you can repay from expected harvest proceeds and keep tenancy and farm records ready in case the underwriting bank asks for verification.

How to apply online: application steps, portals, and support

Start your online application at the PMYP portal to request seasonal working capital and track progress in real time.

Start here: visit https://pmyp.gov.pk/bankform/newapplicantform. No physical forms are accepted; all applications must be submitted online.

Step-by-step process

- Select the amount and purpose (seeds, fertiliser, diesel) that match your cropping plan.

- Upload clear scans of CNIC and farm proof, then complete e-KYC and e-sign the form.

- Approved funds are deposited into the linked bank account; monitor status via the app or portal.

Tools and support

Use the PMYP app dashboard to submit a loan application and check review status in real time.

Prepare ahead: download the repayment calculator and templates (Balance Sheet, Cashflow, Income Statement) to estimate affordability.

If you need help, contact SMEDA’s provincial offices for free advisory on documents and business planning. Call or email the listed helplines to get one-on-one guidance before you submit.

Loan amounts, pricing, and repayment timelines

Clear details on caps, tenors and pricing make it easier to choose between short-term input credit and longer business financing.

Unsecured input facility

Up to Rs 1,000,000 is available per farmer for seasonal inputs. Funds are sent directly to your bank account after approval, so purchases align with sowing windows.

Repayment horizons

Typical repayment terms run from 6 to 12 months, timed to match sowing-to-harvest cash flow. This helps borrowers plan realistic repayments tied to expected yields.

Warehouse receipt financing

Store grain in a certified facility and use an Electronic Warehouse Receipt (EWR) to unlock finance. You can borrow up to 70% of the commodity’s market value against the EWR.

PMYB&ALS tiers (T1–T3)

- T1: up to Rs 0.5 million at 0% for up to 3 years. Ideal for small working capital needs.

- T2: >Rs 0.5 million to Rs 1.5 million at 5% with working capital up to 5 years.

- T3: >Rs 1.5 million to Rs 7.5 million at 7%—working capital up to 5 years; development loans up to 8 years and typically secured.

Underwriting note: banks expect clean credit behavior and accurate documents such as CNIC and EWR where applicable. Match the requested limit to conservative yield forecasts and use repayment calculators before you apply.

Conclusion

Before you submit, confirm the requested amount fits expected harvest income and repayment timing. ,

Apply only at https://pmyp.gov.pk/bankform/newapplicantform and complete e-KYC with e-sign. Track status via the PMYP app so applications submitted get fast responses.

Use SMEDA advisory and calculators to size requests. Choose between the quick input facility and a longer-term PMYB&ALS option: T1 up to Rs 0.5 million and T2 up to Rs 1.5 million.

Note eligibility: resident Pakistanis with valid CNIC and clean credit records. Non-resident Pakistanis and government employees should not apply.

For startups and related businesses in the agri value chain, consider a business agriculture loan or agricultural loan to support equipment, storage, or services.

See Also;