How to Apply For Maryam Nawaz Karobar Card Loan Scheme?

The Maryam Nawaz Karobar Card Loan Scheme or Asaan Karobar Card (AKC Punjab) as pertains to its formal designation, is an initiative of the Punjab Chief Minister, Maryam Nawaz Sharif, aimed to facilitate small and medium enterprises (SME’s) in Punjab. The scheme provides interest free loans up to the value of PKR one million to stimulate entrepreneurship, accelerate development at the local level, and promote employment opportunities in the region. Further down this page is a comprehensive tutorial on eligibility, features, and aplication procedures.

What is Asaan Karobar Card?

The Asaan Karobar Card is synonymously recognized as the Maryam Nawaz Loan Scheme. It is especially meant for the development of small and medium enterprises (SMEs) in the Punjab region. The card is associated with digital financing, permitting small entrepreneurs in Punjab to obtain financing through an uncomplicated digital method. Asaan Karobar Card provides SMEs with Working Capital needs in the form of expenses credit. The card allows business expenses to be funded without the interest as an added credit perk. Additionally, repayment is at the borrowers discretion.

Key Benefits of the Maryam Nawaz Loan Scheme

| Feature | Details |

|---|---|

| Loan Amount | Up to PKR 1 million |

| Tenure | 3 years (with 12-month revolving credit) |

| Repayment | 24 equal monthly installments after the first year |

| Grace Period | 3 months from card issuance |

| Interest Rate | 0% |

| Cash Withdrawal Limit | Up to 25% of the loan limit |

| Eligible Expenses | Vendor payments, utility bills, taxes, and business-related cash needs |

Requirements of Eligibility

In order to acquire the Asaan Karobar Card, the applicants need to:

Possess a valid Pakistani citizenship and age between 21 to 57.

Live in Punjab alongside possessing a valid CNIC.

Have an existing or desired business in the Punjab region.

Possess a credit history that is free of adverse loans.

Complete both credit testing and psychometric testing.

Note: An individual or business is permitted only one application submission.

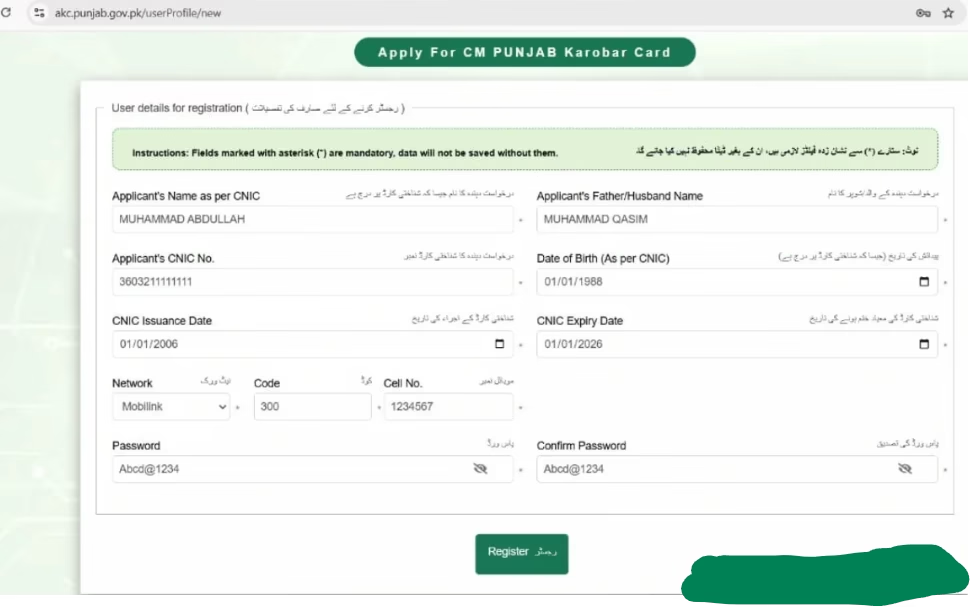

Steps For Applying For Maryam Nawaz Asaan Karobar Card Loan.

Step 1: Register on The Official Portal

Access the Asaan Karobar Card Portal: https://akc.punjab.gov.pk/login.

- Select ‘Register Now’ for entering the following information:

- Mobile (unique to you)

- Your information (full name, fathers full name, ID card, DOB)

- Full and lowercase letter along with a number and special character, passcode of at least 8 digits.

Step 2: Complete the Application Form

Upon Logging in:

Make sure to always save your progress after every section.

Fill in the:

Personal Info: Family details, address, educational qualifications, and work history.

Business Details: Description of the business, registration authority, income, employee count, and expenditure.

Definitions of Loan Needs: Specify the amount as in PKR 100, 000 – 1,000, 000 and state for what purpose (the system will automatically populate as “working capital”).

Step 3: Upload Documents

Front/back copies of CNIC.

1-2 years bank statements (if available) to strengthen your application.

Step 4: Make Payment of Processing Fee

Non-refundable PKR 500 fee must be paid through the 19-digit PSID generated on the portal.

Payable via mobile banking, ATM, or at the bank counter (select 1Bill – Invoice/Fixed Payment).

Step 5: Submit the Application

Ensure every information entered is correct with such details and select “Submit.”

Must record the confirmation message/ registration number for following up.

Note: In case you see the “Submit” button greyed out, that means your application is pending submission.

Karobar Card Loan Repayment & Usage Rules

Initial 50% Of Funds: Accessible immediately; must be spent within 6 months.

Further 50%: To be received after paying in compliance with set PRA/FBR registration repayment terms.

Repayment Schedule:

Initial Grace Period: 3 months (no payments required)

Post Grace Period: Commence payment of 5% of the principal on a monthly basis.

Year 2–3: Remaining balance paid over the course of 24 equal installments.

Restrictions:

Monies are strictly for business expenditures (i.e., personal use is prohibited).

Registration with Punjab Revenue Authority (PRA) is mandatory within 6 months.

Charges & Fees

Annual Card Fee: PKR 25,000 + FED (will be deducted from the loan).

Covered by the Scheme: Life Insurance, Card Issuances and Delivery.

Late Payment Charges: Charge as per the bank policies.

Looking for assistance?

Reach out to the Asaan Karobar helpline at 1786 for help.

Final Tips Before Applying Online

Verify all details prior to submission.

Have your CNIC and other business files ready.

For new business start-ups, utilize available feasibility studies on the PSIC and BOP websites.

The Asaan Karobar Card is an unparalleled opportunity to expand one’s business without risk for entrepreneurs in Punjab. So, apply now and take the first step towards financial independence.